In this month’s edition of FO Perspective, we ask “what is the form of good stewardship”?

Stewardship. What a popular word in family governance circles. Important? Absolutely. But the Wealth Equation reveals an important take on the “stewardship” definition. Hopefully you agree, dear reader, that my definition tweak is for the better!

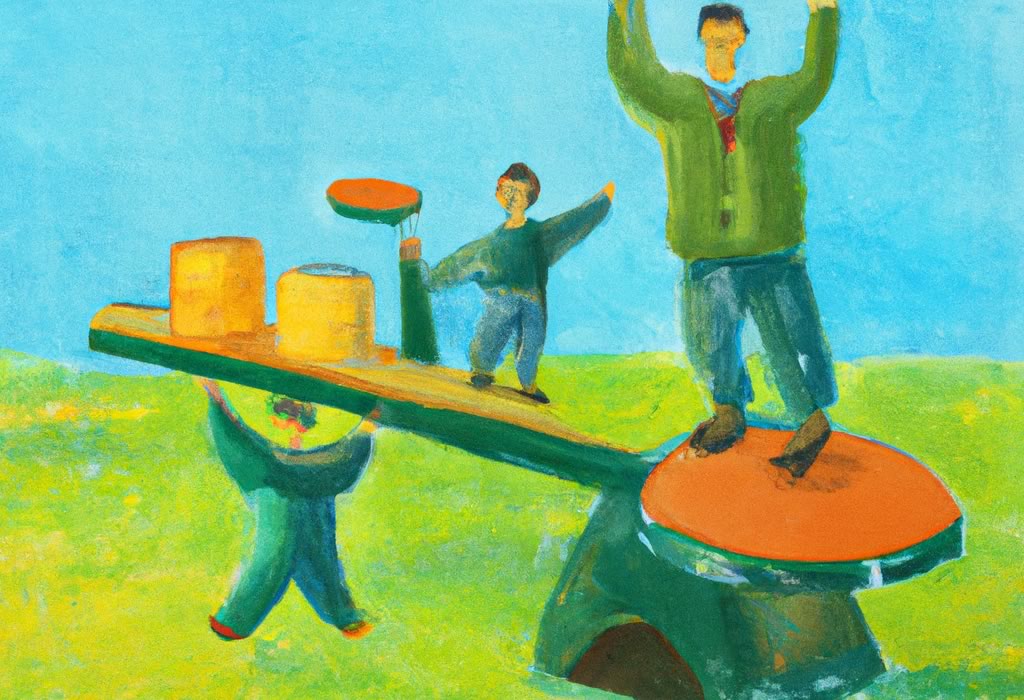

The Wealth Equation: FW = R (HC + RC)

Your family wealth is equal to your resources multiplied by the sum of your human capital (quality of people) and relational capital (quality of relationships).

R

Stewardship is most commonly thought of as the efforts towards protecting the family’s financial capital. Stewarding the wealth through generations requires a keen eye on effective uses of financial capital.

But as stewards I believe we become a little too focused on losing the money. It’s a very common fear. Wealth preservation cannot be the only goal with the capital.

Perhaps this perspective comes from the wealth creators, who saw the luck and effort first-hand required to amass the wealth. Perhaps this perspective comes from the wealth heirs, who see the money as culturally success-defining for their lives. And so long as more wealth exists when they die than when they inherited, they were deemed “successful”.

Both of these fears arise from a misunderstanding of money as a resource.

Given that meaningful family legacies arise from growing your people and strengthening their culture, the money might blissfully float unrisked through the generations and, sure, financial stewardship succeeds.

But often that use of financial capital will fail the family wealth and impair meaningful family legacy.

Stewardship includes stewarding forward what the family stands for. And I hope each and every family with a champion reading this (like yourselves!) knows exactly what your family stands for and how to steward those goals aligned with those values and principles.

HC

Arriving at a healthy relationship with the wealth and understanding the power of effective stewardship is a journey for every individual in the family. Certainly, the more family members that take the time to consider their fears around wealth, fear-set those, and arrive at an upgraded definition of stewardship will be increasing the family’s Human Capital.

RC

Communal pressures around wealth preservation are tricky. Those principles are valuable and certainly the opposite view, a frivolous view of the wealth, is much more destructive for the family. So the family culture has to apply some value to wealth preservation.

But in considering the stewardship of wealth, I believe family cultures should develop an abundance mindset. Combining a discipline of financial preservation with a scarcity mindset leads to overly fearful deployment of capital.

It should be entirely ok for family cultures to deploy capital into their people and their relationships and into investments that may lose capital if there are valuable other goals achieved. For example, with both success or failure of an entrepreneurial venture, risking the capital and unearthing valuable lessons from the failures should be supported by the family.

There should be a celebration of those lessons and a healthy relationship developed around failures in any family culture. No pariahs.

Conclusion

Regardless of the choices we make, outside forces could make the money disappear at any moment.

And what is left after the money is gone (or you pass away) is the relationships and the culture that can breed the kind of people that you are proud of. People capable of rebuilding wealth if need be. People you are proud to call family.

Because after all, time is our greatest resource and spending it wisely is far more valuable to your family than prudent investing.